Williams-Sonoma surges 27.5% to record high

Home-products retailer WSM is one of the 2024 Dividend Heroes

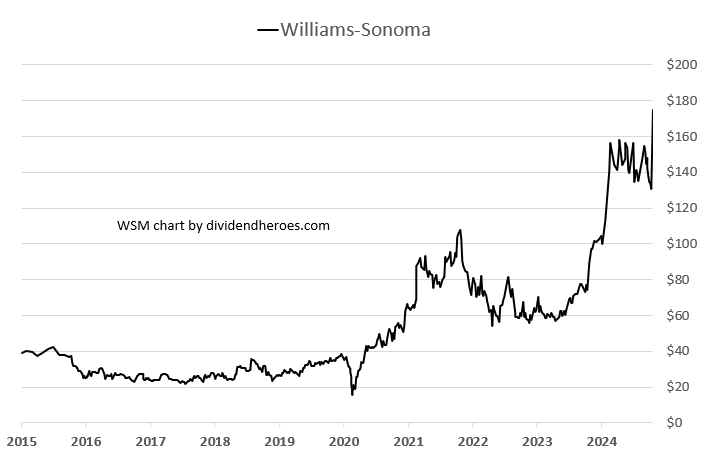

Williams-Sonoma's stock surged 27.5% to $175, reaching a record high after reporting stronger-than-expected Q3 earnings and raising its full-year outlook ahead of the holiday season. The company, which owns Pottery Barn, posted net earnings of $249 million, or $1.96 per share, beating analysts' estimates of $1.77 per share. Revenue dipped slightly to $1.8 billion but exceeded forecasts. CEO Laura Alber credited improved sales trends, market share gains, and profitability, while CFO Jeff Howie highlighted lower input costs and a focus on full-price sales as key contributors.

Williams-Sonoma (symbol WSM) now expects annual net revenue to fall between 1.5% and 3%, an improvement from its prior forecast of a 1.5% to 4% decline. It also raised its annual operating margin outlook to 18.4%-18.8%, up from 18.0%-18.4%. The strong Q3 results were supported by successful furniture launches during the fall season and a reduction in promotional activity, which boosted margins.

The board approved a new $1 billion stock repurchase program to take effect after the current authorization is fully utilized. Including the $293 million remaining under the March program, the total buyback authorization stands at $1.3 billion. The company also plans to further reduce its reliance on Chinese manufacturers, with China-sourced products now making up about a quarter of its mix, down from roughly half.

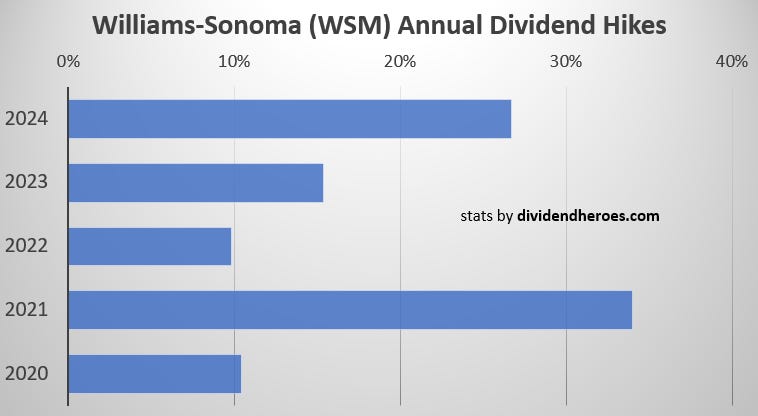

Williams-Sonoma is one of the top-25 Dividend Heroes for 2024 based on its strong dividend growth and other statistics including buybacks, track record and yield. Even with today’s 27.5% stock price surge the dividend yield is 1.7%.

WSM hiked its dividend by 26.7% in 2024, marking 18 consecutive years of dividend increases. The 5-year CAGR is a whopping 18.9%.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.