Dividend Hero Coloplast from Denmark is renowned for its strong dividend track record, boasting over 25 consecutive years of increased dividends. This achievement places the healthcare products maker among Denmark’s few Dividend Aristocrats, alongside the more widely recognized Novo Nordisk. Both companies are classified as Dividend Heroes. However, there is a notable difference: in 2024, as #8 Novo Nordisk ranks among the top 25 Heroes, while Coloplast holds the #45 position.

Only the 25 highest-ranking dividend stocks are included in the annual selection for the USA, Europe, and Japan. This means that, while Coloplast is a hero, it does not contribute to the annual returns. And because Coloplast just announced a dividend hike of less than 5% for the latest fiscal year, the company will not be able to make the Dividend Heroes Selection for 2025.

About Coloplast

Coloplast is a Danish company specializing in innovative healthcare solutions that significantly improve the quality of life for people with medical needs. The Coloplast story began in 1954 when nurse Elise Sørensen was inspired to create a new type of medical product. After her sister Thora underwent an ostomy operation, she felt afraid to leave the house, worried her stoma might leak. Elise envisioned the idea of the world’s first adhesive ostomy bag, a simple but groundbreaking solution to prevent leaks and enable her sister to live freely.

Elise’s idea was brought to life by civil engineer and plastics manufacturer Aage Louis-Hansen and his wife, Johanne Louis-Hansen, a trained nurse. Together, they developed an ostomy bag that provided security and freedom for Thora—and eventually, for thousands of others facing similar challenges.

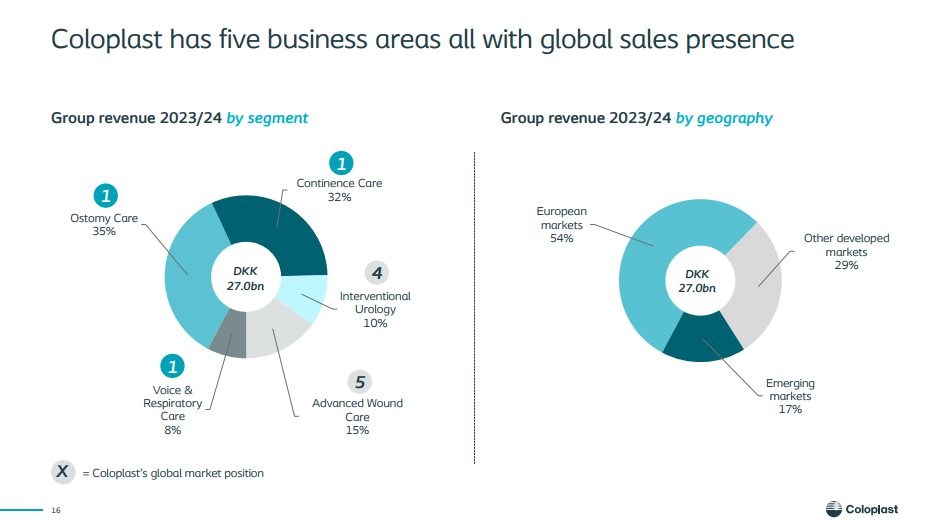

Today, Coloplast’s product offerings have expanded far beyond ostomy care, covering areas such as Continence Care, Advanced Wound Care, Interventional Urology, and Voice and Respiratory Care. The company has grown into a global operation with close to 16,000 employees, continuing its mission to provide life-changing solutions to people worldwide.

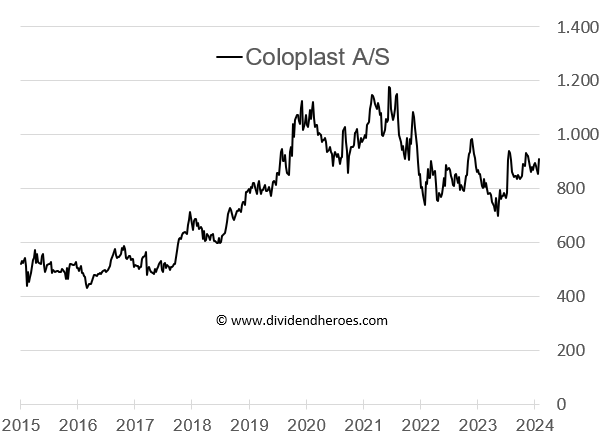

For the fiscal year ending September 2024 Coloplast reported a 10.3% revenue growth to a new record high of DKK 27 billion. Coloplast stock is up 14.3% YTD at a stock price of DKK 882.

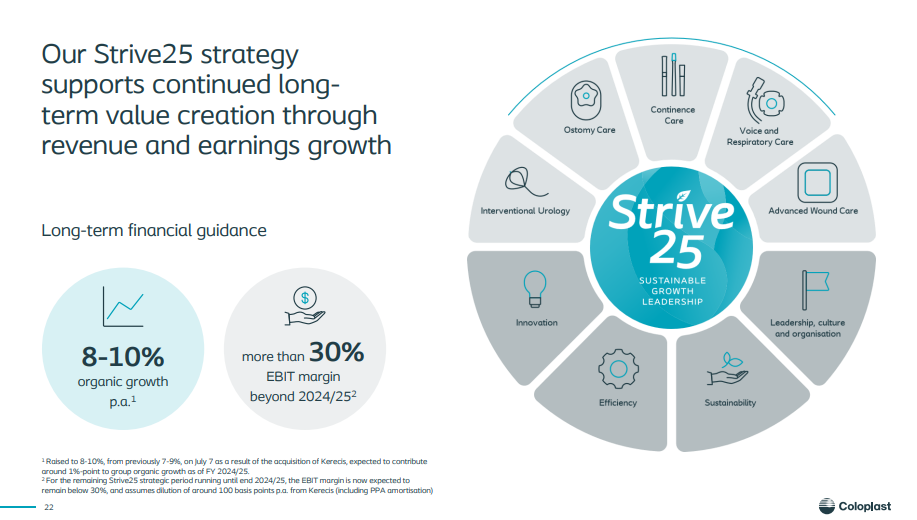

The return on invested capital (ROIC) stands at 16.9% and is expected to jump to 21.8% next year. Coloplast has a high EBIT-margin of 27%, expected to jump to 28% for this (FY 2025) fiscal year. With a p/e of almost 35 for FY 2025 the valuation remains high.

The Dividend

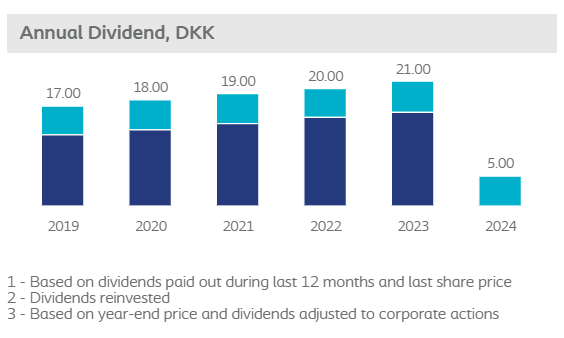

On November 5, 2024, Coloplast declared a DKK 17 per share final dividend, up 6.3% from 2023. Earlier an unchanged DKK 5 interim dividend was paid, bringing the FY dividend growth to 4.8%.

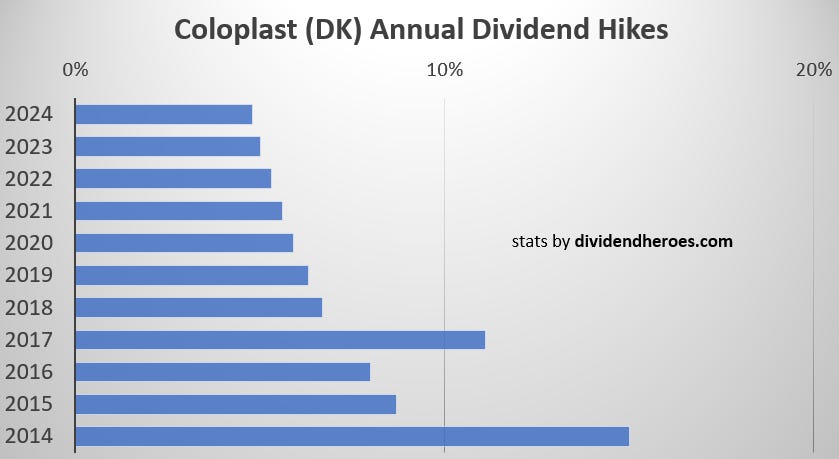

This means that the Coloplast dividend growth drops below 5% for the first time in decades and most likely the first time ever since they started paying a dividend. Dividend growth has been slowing for year now at Coloplast with the last double digit increase dating back to 2016 (+11.1%).

Coloplast will not qualify for the Dividend Heroes Selection in 2025, as its latest dividend increase fell below the 5% threshold required for eligibility. This marks the end of Coloplast's longstanding presence on the Dividend Heroes list—a distinction it has held every year since we began tracking Heroes in 2016.

According to our criteria, a dividend growth rate below 5% does not meet the standard for selection as a Dividend Hero. While Coloplast remains a strong company with a proud dividend history, this year it’s a farewell from the Dividend Heroes.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.