Buffett bought Dividend Heroes DPZ and POOL

🍕🏊 Berkshire Hathaway’s latest bets: Domino’s Pizza and Pool Corporation

Big news in the investing world: Warren Buffett has added two new stocks to Berkshire Hathaway’s portfolio! These companies are not just industry leaders; they are Dividend Heroes, celebrated for their impressive track records of consistent and significant dividend growth.

Let’s dive into Buffett’s recent acquisitions and why he’s putting his money on pizza and pools.

What Did Buffett Buy?

According to a Q3 2024 filing with the SEC, Berkshire Hathaway has taken stakes in Domino’s Pizza (DPZ) and Pool Corporation (POOL):

Domino’s Pizza: 1.28 million shares, valued at $549 million.

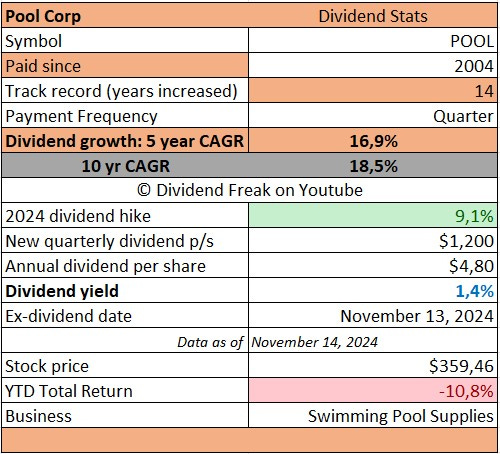

Pool Corporation: 404,000 shares, valued at $152 million.

These moves have turned heads in the financial world, as shares often rise following Berkshire's investments, reflecting the market’s confidence in Buffett's stock-picking prowess. While we don’t know if these picks were made by Buffett himself or his portfolio managers, Todd Combs and Ted Weschler, one thing is clear: these stocks are packed with potential.

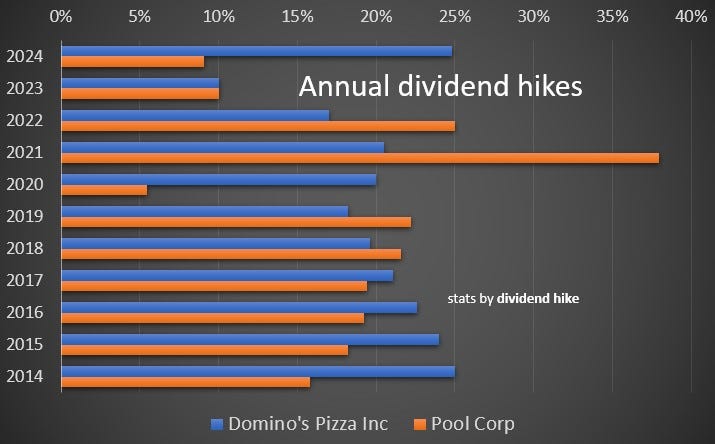

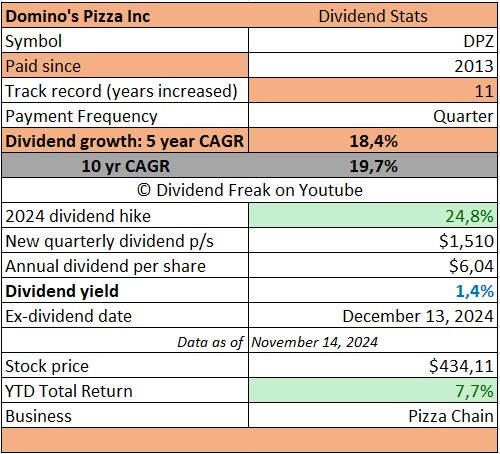

Both investments share a unique feature—an exact dividend yield of 1.4%, coupled with annual double-digit dividend growth. Let’s explore why Buffett chose these particular Dividend Heroes.

Why Domino’s Pizza?

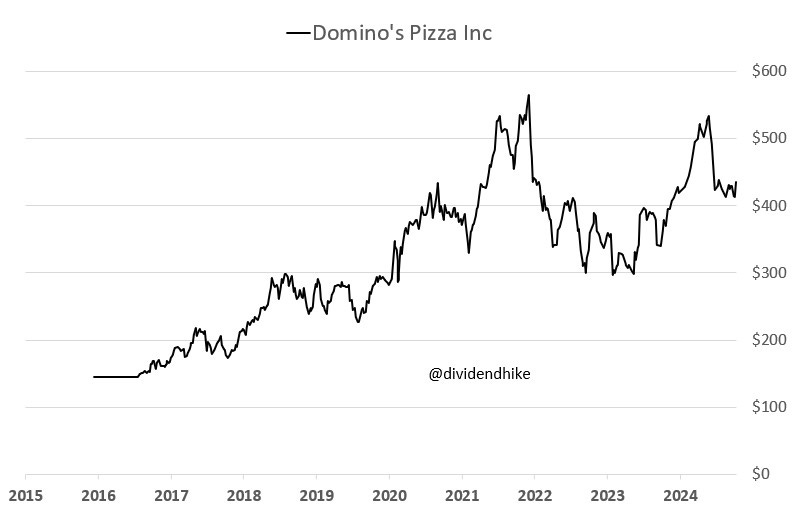

Buffett’s investment in Domino’s Pizza isn’t surprising when you consider its robust dividend history, reliable business model, and leadership in the growing food delivery market.

A Leader in Pizza and Innovation

Domino’s is one of the world’s largest pizza chains, with over 20,000 locations in 90+ countries. Known for its cutting-edge technology in online ordering and delivery, Domino’s has cemented itself as a leader in the booming home delivery market.Dividend Hero Status

In 2024, Domino’s raised its dividend by an incredible 24.8%, bringing it to $1.51 per quarter—its 11th consecutive year of double-digit dividend growth. Over the past decade, the company has averaged nearly 20% annual dividend growth, a remarkable feat. Add to that its consistent share buybacks, high returns on invested capital, and strong profit margins, and it’s clear why Buffett sees this as a winning investment.Room to Grow

Despite recent stock price declines, Domino’s fundamentals remain strong. Its timeless product and ability to adapt to changing consumer preferences make it a defensive yet growth-oriented choice.

Why Pool Corporation?

Buffett’s choice to invest in Pool Corporation is just as compelling. While it may not seem as glamorous as pizza, Pool Corp holds a dominant position in a niche market with strong growth potential.

A Market Leader in Home Recreation

Pool Corporation is the world’s largest distributor of swimming pool and spa supplies, equipment, and parts, with a network of over 400 distribution centers across North America, Europe, and Australia. The company benefits from trends like increasing home recreation, luxury spending, and sustainability-focused water treatment.Dividend Hero Status

In 2024, Pool Corp increased its dividend by 9.1%, marking its 14th consecutive year of growth. Over the past decade, its average annual dividend growth has been an impressive 18.5%, making it a standout among dividend-paying stocks.A Rebound Opportunity

Pool Corporation’s stock has taken a hit this year, making it an attractive value play for Buffett. Its combination of strong cash flows, competitive advantages, and attractive profit margins makes it a solid long-term investment.

Conclusion: Why Buffett Loves Pizza and Pools

Buffett’s latest picks reflect his time-tested strategy: find companies with strong fundamentals, consistent dividend growth, and long-term potential. Both Domino’s Pizza and Pool Corporation deliver on these fronts.

Dividend Growth Excellence: Both companies boast double-digit dividend growth and stable cash flows.

Market Leadership: Whether it’s pizza delivery or pool supplies, these firms dominate their industries.

Attractive Value: Recent price declines make these stocks appealing buys.

It’s easy to see why Buffett finds these stocks irresistible—and who doesn’t love pizza and swimming pools?

Please note that both Pool Corp and Domino’s are NOT in our top-25 selection for 2024. Both stocks are Dividend Heroes, but we only track performance for the top ranked 25 stocks.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.